FinOps

What is FinOps?

FinOps -- a combination of the terms finance and DevOps -- is a framework for managing Opex across an organization, often in conjunction with the cloud and cloud computing. An important goal of FinOps is to help engineering, finance, business and technology teams within the same organization achieve business value and maintain financial accountability for cloud services. Best practices for FinOps were developed by the FinOps Foundation, a nonprofit trade association whose members include Atlassian and Cloudify.

FinOps goes beyond the goal of simply saving money and strives to drive revenue by helping cross-discipline teams collaborate to make the best decisions regarding performance, quality and cost in technology investment and execution decisions mainly surrounding cloud decisions and usage. The idea is that a business makes the "best" investment decisions, not just the lowest cost decisions.

What is the FinOps Foundation?

The concept of FinOps is closely tied to the FinOps Foundation. Though it doesn't set business or technology directives -- there's no correct way to implement FinOps -- the Foundation promotes guidelines, best practices and training designed to help distributed teams running in the cloud take advantage of the economic benefits offered by cloud deployments. FinOps supporters seek to create strong communication between an organization's IT and finance teams so stakeholders can quickly and easily determine which cloud services are providing business value and which are not.

Today, the FinOps Foundation includes over 5,300 individual members from more than 1,500 companies. The Foundation provides various FinOps training and certification programs, such as the FinOps Certified Practitioner certification, as well as the FinOps Certified Platform and FinOps Certified Service Provider recognitions.

Review these FinOps best practices to reduce cloud costs.

History of FinOps

It's hard to cite a singular timeline for FinOps because of its rapid emergence and diverse industry project involvement -- many organizations and contributors have influenced the recent emergence of FinOps. But it's worth considering its basic historical origins.

The fundamental premise behind FinOps is to help a business make the most efficient and beneficial technology investments for a business. This might involve centralizing procurement, buying resources in volume and negotiating the best deals. However, this isn't a new idea as businesses have sought cost management efficiencies in some form since the age of industrialization.

The dawn of the digital age saw the emergence of computing as a new type of manufacturing where data centers and computers took the place of traditional physical manufacturing equipment. Today, computing is often the very nature and product of the business itself, such as Google. Businesses systematically applied the concepts of basic finance and financial efficiency to data center facilities and IT infrastructure to ensure computing capital was procured and deployed in the most strategic, useful and cost-effective manner for the business.

The rise of cloud computing in the 21st century put a new emphasis on cost and cloud financial management. Cloud computing provides computing-as-a-utility, enabling businesses and business leaders to access infrastructure and services on-demand through third-party cloud providers, such as AWS, Google and Azure. The loss of centralized procurement, gaps in financial accountability and complex cloud pricing structures rapidly led to financial waste in excess, redundant or unnecessary cloud computing usage.

The idea of FinOps arose as a means of applying traditional financial sensibilities to cost and resource management for outside services -- particularly cloud computing and multi-cloud usage within a variable budget -- while supporting dynamic business efforts such as DevOps. The idea is simple; rather than let every department manager or application stakeholder make their own cloud decisions, gather a collaborative cross-discipline group to achieve the following tasks:

- evaluate workload needs;

- architect the most efficient cloud architecture for the application;

- centrally negotiate the most efficient cloud pricing;

- utilize cloud resources from a common pool, and;

- apply best practices for budgeting, procurement, reporting, monitoring and management.

The FinOps Foundation was formed by the Linux Foundation on August 20, 2020. The purpose of the Foundation is to advance the discipline of cloud financial management through best practices, education and standards. The Foundation launched with strong support from major industry organizations, including:

- Apptio,

- Cloudeasier,

- Cloudsoft,

- CloudWize,

- Contino,

- Kubecost,

- Neos,

- Opsani,

- ProsperOps,

- Timspirit and

- VMware.

FinOps lifecycle

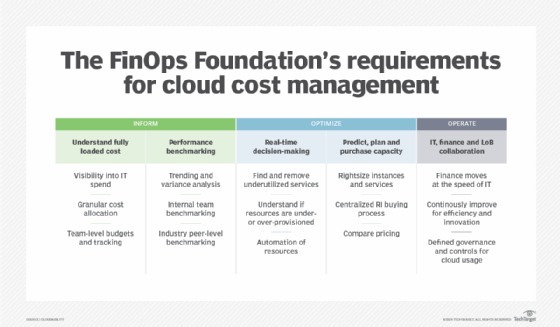

The FinOps Foundation recommends an iterative approach to managing the variable cost of cloud services. Best practices include the following three phases that should be continually managed.

- Inform. Cost allocation and management can't exist without accurate and timely information. Such visibility is the key to benchmarking, budgeting and forecasting, and is essential for determining ROI and other business benefits. Information may include mechanisms such as resource tags and business mappings so that each cloud consumer can be readily identified and monitored.

- Optimize. Optimization involves both cost and resource use. In some cases, optimization may rely on cost savings, such as reserved instances or committed use discounts, to save money for long-term instance use. In other cases, optimization may rely on scaling back or turning off underutilized or unneeded resources. Yet other optimizations may focus on workload performance; scaling up vital resources to ensure adequate workload performance in response to increasing or variable demand.

- Operate. Operation involves the ongoing use of FinOps metrics to evaluate the performance, quality and cost benefits of workloads in the cloud. This phase enables business, finance, technology and engineering staff to collaborate with other stakeholders about workload activity and governance.

It's important to note that these three phases of FinOps can exist simultaneously for different cloud projects or workloads across the business.

Take this quiz on FinOps principles and concepts.

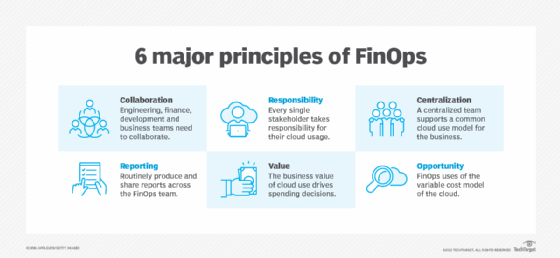

FinOps principles

FinOps is built upon a series of practices or principles that underscore the major goals of a FinOps environment. These are general guidelines that can be readily adapted to fit the specific needs of individual organizations.

- Collaboration. FinOps teams need to collaborate, which requires input and constructive support from business, finance, technology and engineering teams. Good collaboration requires removing traditional silos and encouraging some parts of the business to adapt to changing dynamics of cloud use.

- Ownership. While a FinOps team can provide a business with a centralized cloud center of excellence, FinOps principles encourage direct visibility and stakeholder ownership of their cloud use against the established budget. Each workload owner or department understands and takes responsibility for their portion of cloud utilization.

- Centralization. The FinOps team can provide a core of knowledgeable professionals capable of centralizing important resource and cost elements of cloud use. The FinOps team can negotiate and manage issues such as committed use discounts, reserved instances and volume discounts. This alleviates cost concerns from other cloud stakeholders and can enable the most cost-effective cloud resources available for workload deployment.

- Reporting. FinOps teams rely on accurate, complete and timely reporting so the team and workload owners receive prompt feedback and make critical decisions as quickly as possible. Reporting can also help visualize trends and enhance forecasting.

- Value. Decisions are driven by the business value of the cloud -- not simply cost. The main premise here is that FinOps relies on quality data, such as benchmarks and reporting, to establish a meaningful balance of performance, quality and cost of cloud use for the business.

- Cost. FinOps teams use variable cost models of the cloud to the organization's advantage, enabling teams to optimize instances and services to appropriate levels and find the best pricing by comparison shopping.

FinOps stakeholders

There are no set requirements for team size or composition, but The FinOps Foundation defines the following five major stakeholders -- dubbed personas -- that typically collaborate in a FinOps environment:

- Executives. Business-side concerns are typically represented by one or more executives such as a CIO, CTO or a head of Cloud Center of Excellence. Executives generally focus on team efficiency, accountability, budget management and transparency.

- Product owners. Similar to executives, product owners generally represent the department heads or project leaders directly responsible for creating, deploying and managing cloud workloads for the business. These can also include a director of cloud optimization, a cloud analyst or a business operations manager.

- Engineering. FinOps needs individuals that understand and use cloud technology such as software engineers, systems engineers, cloud architects and engineering managers. These are the FinOps team members that translate budgets and requirements into actionable cloud environments where workloads are deployed. Engineering team members also handle much of the troubleshooting, automation and scaling needed to optimize a cloud workload.

- Finance. A key aspect of cloud use is cost, and finance professionals such as procurement specialists, financial planners and business financial advisors will help to establish budgets, handle accounting and implement cloud forecasting. This typically involves using ongoing billing to create more accurate cloud cost models. Finance specialists may also take on price negotiations with cloud providers.

- Practitioners. A FinOps practitioner is a relatively specialized or dedicated role intended to facilitate FinOps environments and initiatives, effectively leading collaboration and guiding FinOps team members through prescriptive activities and best practices.

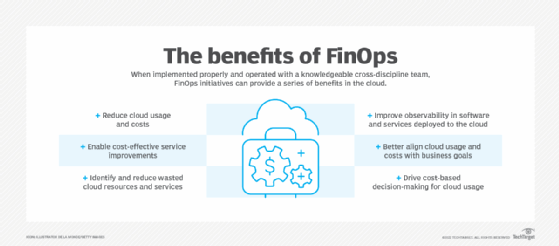

Benefits of FinOps

When properly implemented, FinOps practices and guidelines can provide an assortment of benefits to the cloud-based business, such as:

- Cost savings. The business can save money by lowering cloud spend, reducing wasted or unused resources, or by making more effective investments in cloud resources, such as securing reserved instances for long-term workloads rather than using instances on-demand.

- Cost visibility. Stakeholders and financial teams can use detailed cloud reporting to see how budget is being spent in the cloud by department or workload.

- Cost accountability. Costs are allocated to stakeholders or project owners who are directly responsible for the cloud spend and its effect on the business.

- Cost optimization. By understanding resource utilization and corresponding costs, technology teams can potentially seek ways to optimize and enhance workload performance to save money or maintain performance through workload growth.

Challenges of FinOps

Despite the compelling benefits, FinOps can pose several potential challenges for unprepared organizations. Common FinOps challenges include:

- Tool challenges. Businesses require numerous tools or platforms suited for FinOps planning, such as cost optimization tools for specific cloud providers and even tools with multi-cloud support.

- Collaboration challenges. FinOps works best when the FinOps team includes engineering, technology, finance and business representation. This can pose challenges for businesses with traditional silos or those lacking the incentive to work collaboratively.

- Management challenges. FinOps relies on best practices, policies and processes to achieve cost and technological efficiency. If not properly implemented, a FinOps initiative can fall short or fail.